Market Update: Monday, February 17, 2025

The market broke out of its three-week consolidation to the upside, but can we make a push toward new all-time highs this week?

Disclaimer: These are my learnings and opinions only, not financial advice. If you are newer to trading, please read my Getting Started guide to understand the terminology and tools I use. You can also follow me on X where I share some of my trades in real-time.

Market in Review

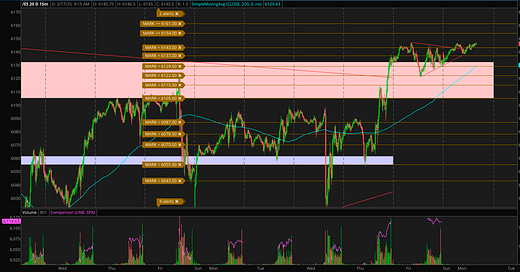

SPX/ES: On Friday, /ES dropped to the 6120 level — backtesting the pennant trendline like I mentioned in Thursday’s update — but then continued its path higher albeit a bit choppy. Next targets remain 6162 (January 24 high and also near the /ES sweet spot top), and 6184 (all-time high from December 6).

A few things that make me cautious:

I wouldn’t be surprised to backtest that 6120 level, 6107 (8EMA), or 6093 (20SMA) to form the “handle” of a bullish cup & handle pattern on /ES. You can see the “cup” on /ES chart above going from January 24 to February 14. Basically, we could see more consolidating before an eventual break higher.

The second half of February tends to have weaker seasonality, before continuing to rise again in March. I’m seeing targets for $SPX at 6230 and 6430 if and when we do breakout above all-time highs.

There was a huge $5.8m buy of $VIX Mar 21 23c on Friday, and with VIXperation and Monthly OPEX (more on this below) this week, as well as the threat of more tariff tape bombs, some choppy action or pullbacks are possible.

Keep reading with a 7-day free trial

Subscribe to The Liquid Update to keep reading this post and get 7 days of free access to the full post archives.